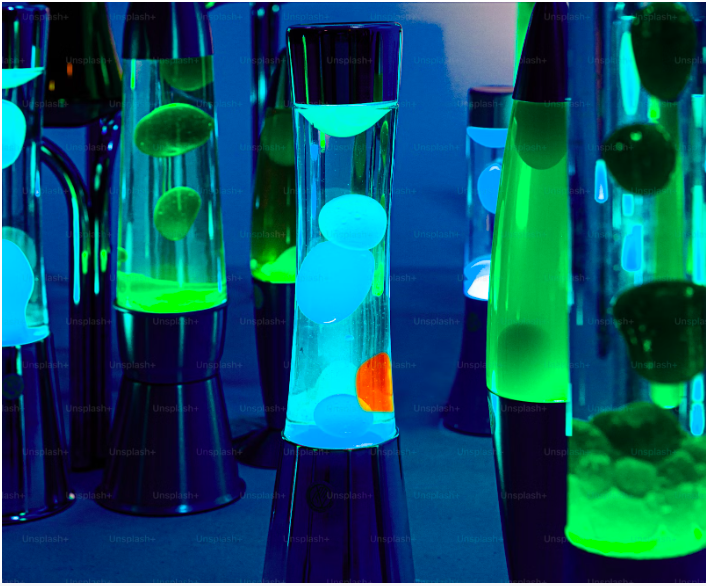

Remember the mesmerizing glow and soothing motion of lava lamps? While they might feel like a retro relic from the ’70s, they’re still a favorite for creating a little magic at home. The good news? You don’t need to buy one—you can make your very own with just a few simple materials and steps!

Not only is this DIY lava lamp an exciting activity, but it’s also a great way to explore the principles of density and chemical reactions. Let’s dive in!

What You’ll Need:

- A clear jar or bottle (any size works, but transparent is key)

- Water

- Vegetable oil

- Food coloring (pick your favorite color!)

- Effervescent tablets (like Alka-Seltzer)

- A flashlight (optional, for extra effect)

Step-by-Step Guide:

- Set the Stage: Start with your clear container. This will be the “lamp” where all the action happens. Make sure it’s clean and transparent for the best visual effect.

- Add Oil and Water: Pour vegetable oil into the container, filling it about three-quarters of the way. Next, add water until the container is nearly full, leaving some space at the top. You’ll notice the water sinks below the oil—a cool first glimpse at the science of density. Water is denser than oil, which is why they separate.

- Add Some Color: Choose your favorite food coloring and add about 5-10 drops to the mixture. The droplets will pass through the oil and mix with the water layer below, creating vibrant pockets of color.

- Activate the Lava: Break and an Alka-Seltzer tablet into smaller pieces. Drop one piece into the container and watch the magic unfold! The tablet reacts with the water, creating carbon dioxide gas bubbles. These bubbles carry the colored water upward through the oil, creating that iconic lava lamp motion. When the bubbles pop at the surface, the water sinks back down.

- Keep It Glowing: Want to take it up a notch? Place a flashlight or small lamp beneath the container for a glowing, illuminated effect. This is perfect for a cozy, magical vibe in a dark room.

The Science Behind the Scene

This DIY lava lamp works because of two main principles: density and chemical reactions. The density difference between water and oil ensures they don’t mix, while the effervescent tablet reacts with water to produce gas. The rising bubbles are what give it that fun, groovy effect!

Tips and Tricks:

- You can use different food coloring combinations to create unique effects.

- Want the lava to last longer? Use smaller pieces of the tablet and add them one at a time.

- To make it even more interactive, experiment with different containers and observe how their shape changes the motion of the bubbles.

Making a lava lamp is easy, fun, and a great hands-on way to explore basic science concepts. Whether you’re doing this as a family project, for a classroom activity, or to add a cool décor piece to your space, this DIY experiment will surely light up your day—literally! ¹ ² ³ ⁴ ⁵