Introduction:

Depending on your knowledge of the cosmos and the laws of thermodynamics, you may or may not have heard of the fascinating concept of Heat Death. Nevertheless, this article will cover almost all the fundamental ideas associated with the universe’s Heat Death and how this may impact the world.

Before we dive into heat death, we must discuss the second law of thermodynamics. The law states that: “in any natural process, the total entropy of a system and its surroundings always increases.” Entropy is commonly termed as disorder; however, this does not have to do with how organized something is but rather how many possible states there are. For example, if you have 4 different colored marbles in a box, each placed in one corner, that is one state. Now, how many possible states/rearrangements can you organize these marbles into? In such a case, having more possible states means you have more entropy.

What is the Heat Death?

The simple way of putting the heat death is an occurrence where the universe can no longer function in which no processes will occur. Keep in mind this process happens gradually and will take place in 10^100 to 10^1000 years.

The Science Behind It:

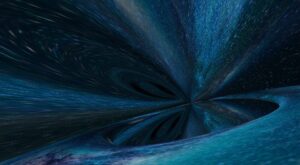

When entropy is applied to the real world, we are referring to how disordered the universe can be as a system. As we complete our everyday tasks, every person adds heat to the overall system. On the larger scale, the universe increases its entropy as stars burn their fuel and cosmic expansion occurs. Such behaviors will decrease the efficiency of heat transfer in the entire universe. In previous grades, you may have heard of things naturally going from hot to cold; a hot cup of coffee cooling down upon sitting on the table. This transfer from hot to cold is crucial in regulating natural processes, hence maintaining lower entropy. Conversely, when galaxies continue to spread out, the universe will lose its ability to transfer heat. This inability to transfer heat will result in isolation and equilibrium of temperatures everywhere. When equilibrium and isolation occur, the entropy of the universe will be at its maximum (extremely disordered). In conclusion, as stars burn, the universe expands, releasing heat, and when the universe reaches thermal equilibrium, the universe will have to face the Heat Death of the Universe.

What Does This Mean For Earth?

As I stated earlier, the Heat Death of the Universe is 10^100-10^1000 years away, and therefore no concern will arise for humanity or even Earth! The human population has evolved for 6 million years, and it will continue to evolve, considering that we are nowhere near the last species on earth. The more tangible question should be what will happen to Earth?

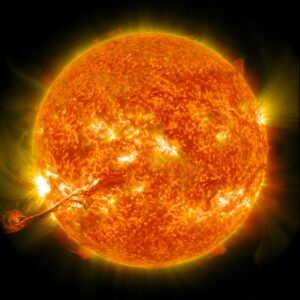

In terms of the next billion years, Earth will no longer remain a habitable place for any life as the sun will evolve into a red giant, which will eventually have the capacity to engulf earth. Additionally, the sun’s escalating radiation will make the planet torrid, and the oceans will ideally evaporate, leaving nothing but an abiotic environment with extreme temperatures.

Takeaway:

While the destruction of life on Earth may seem haunting, science assures you that humanity is nowhere near destruction, hence there is no need for concern. The main takeaway from this article should be centered around obtaining knowledge about the marvellous capabilities of science to determine the future. The next time your coffee cools down, be grateful for the heat transfers and natural phenomena!

Great write-up, I’m normal visitor of one’s website, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

Comments are closed.