On June 12th, 2025, at 8:09 GMT, 230 passengers and 12 crew members took off from Ahmedabad’s Sardar Vallabhbhai Patel International Airport, heading to London Gatwick. Less than a minute later, the plane crashed into the hostel of BJ Medical College in Ahmedabad.

The result? 229 passengers, 12 crew members, and dozens of locals and bystanders were killed.

Survivors? Just one.

Let’s take a look into the horrific and unexpected crash of Air India Flight 171.

HOW did the plane crash happen?

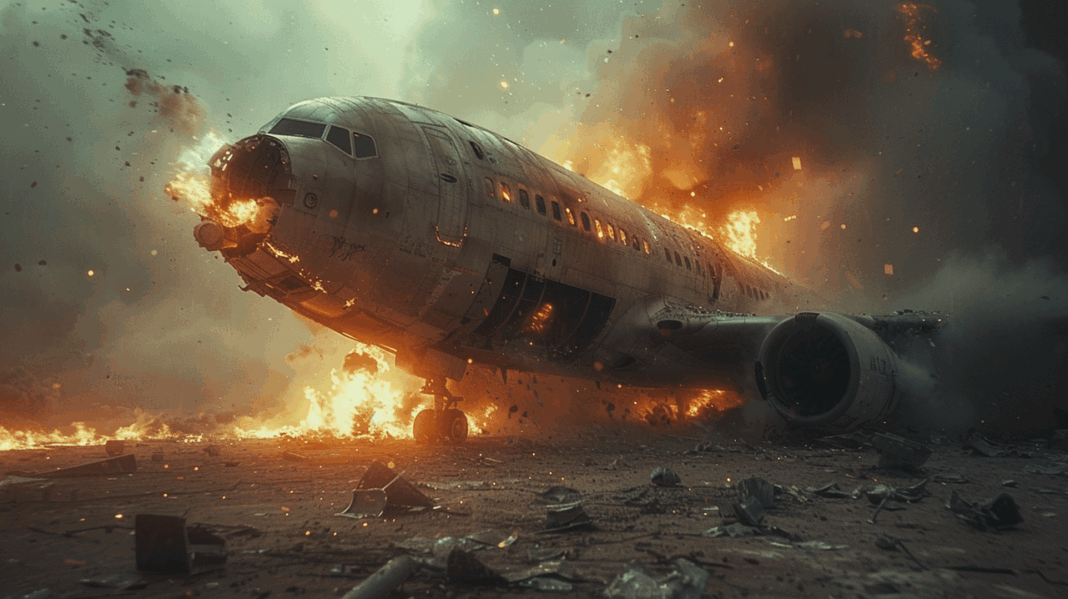

Moments after takeoff, the aircraft rapidly lost altitude and slammed into a building used as accommodation for doctors at Byramjee Jeejeebhoy (BJ) Medical College and Civil Hospital, triggering a massive explosion.

Reports indicate the plane broke in half upon impact, with the rear section catching fire.

WHY did the plane crash?

Based on video footage, aviation experts speculate that improper positioning of the wing flaps during takeoff may have contributed to the crash. However, a definitive cause has yet to be determined.

One of the plane’s two black boxes (flight data recorder) has been recovered. India’s Civil Aviation Minister, Ram Mohan Naidu Kinjarapu, stated, “This marks an important step forward in the investigation. It will significantly aid the inquiry into the incident.”

WHO survived, and HOW?

One man, referred to as the “miracle in seat 11A”, was the sole survivor: 40-year-old British national Vishwash Kumar Ramesh.

“I don’t believe how I survived,” Ramesh said. “For a while, I thought I was going to die. But when I opened my eyes, I realized I was alive. I unbuckled myself from the seat and tried to escape.”

He made it out through a small opening near his side of the wreckage. Ramesh said he suffered impact injuries to his chest, face, and feet.

WHAT happened to the bodies?

Dr. Minakshi Parikh, Dean of BJ Medical College and Civil Hospital, stated they were “relying only on DNA matching to identify them”.

As of June 15th, 32 bodies have been identified, but many families are still awaiting DNA results. And identification has proven extremely difficult, as most of the remains were charred beyond recognition.

TL;DR

On June 12, 2025, Air India Flight 171 crashed less than a minute after takeoff from Ahmedabad, killing 229 passengers, 12 crew, and dozens on the ground. The plane struck a medical college hostel, causing a massive explosion. Only one person, 40-year-old British national Vishwash Kumar Ramesh, survived. The cause is still under investigation, with one black box recovered. Most victims are being identified through DNA, as the bodies were badly charred.

Sources: