Growing crops in a modern way

Since the agricultural revolution that took place more than 12,000 years ago, agriculture has been a vital part of society. Throughout the centuries and millennia that followed, the practice of agriculture has gone through significant transformations. Many ancient civilizations, such as the Inca Empire in South America, used advanced methods like terracing and irrigation systems to farm more efficiently. Today, there are also some highly advanced modern technology that farmers use around the world to grow crops to feed everyone, and to overcome various challenges that agriculture faces.

Some newer technologies

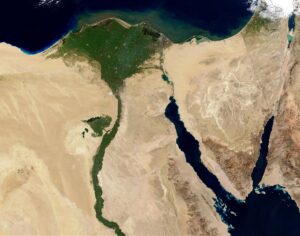

The use of satellites and drones to provide imaging for the farmland, or the surrounding areas of land, provides farmers with the ability to monitor their crops in real time. Can you believe that certain satellites launched into space are able to even zoom to a specific crop on a particular field? This preciseness enables farmers to see their crops to be able to view each individual crop as clearly as if they were standing right by it. According to this binarapps article, these satellites help protect the crops in a farmland, and also boost management efficiency of the farmland.

Soil and water sensors

Providing direct feedback and results to farmers, these sensors can be complex in examining many natural conditions for plants to thrive under. These sensors can be placed in the soil, or even out in the open, to capture important weather data, and the level of certain chemicals in the soil, such as nitrogen. These important tools greatly aid farmers in getting real-time knowledge of when they need to fertilize or water their crops, to make sure that their crops remain strong.

Mini-chromosomes

Mini-chromosomes are another way of saying genetic engineering. Talking about the challenges that the agricultural industry face in our twenty-first century, among the most serious of those are climate change and the ever increasing demand for food. Mini-chromosomes are “tiny structure[s] containing a cell”. It may be small, but it is by no means insignificant, as even a single cell that composes of mini-chromosomes can “add dozens of [new] traits to a plant”.

However, it is also important to note that genetic engineering can be considered as a controversial topic, as debates are ongoing as to whether genetic engineering should be allowed, or to be made more widespread, due to the environmental concerns they pose. These would include the cross-contamination into other wild habitats, the potential to form new allergens, and more.

Appreciating these technologies

There are other technologies as well that are not directly mentioned in this blog! Interesting examples include blockchain, which “improves food traceability” and combats problems in agriculture like food fraud. Various other artificial intelligence tools also exist to further empower those who are working in the agricultural industry. Be sure to check out this article for more information!

Many of these technologies make it possible for us see aisles filled with food crops that are waiting to be sold in grocery stores. Our ability to survive and thrive as humans depends on the sufficient production of crops that can fulfill a healthy and balanced diet. So, let us appreciate these farming technologies that are crucial in the agricultural field!